Does Amazon Accept Klarna

How To Use Klarna On Amazon

There are several ways to use Klarna on Amazon. The first is to download the Klarna app on your phone. Then, you can search for Amazon on the home screen. After you find it, click “Pay with K” to go to the shopping page. You’ll be asked for credit card information. These details will be required to confirm your payment. Then you can choose to make one payment or four installments. To pay off your entire purchase at once, you can set up interest-free payments.

You will need a Google Chrome browser to use Klarna Amazon. The app will be downloaded. After you’ve downloaded it, you need to log in to your Klarna account. The first thing you will need to do is provide your basic information. This includes name, address and banking information. You’ll then be directed to the site where you’ll be paying. You may have to pay another way depending on the rules of your bank.

Download the Klarna App. Once you have downloaded the app, fill in your credit card details. To verify your identity, and to establish your spending limits, a soft credit inquiry is conducted. It will not affect your credit score or appear on your credit reports. You will need your bank account details to get Klarna started. You’ll need to have a minimum of $10 to use Klarna, but the maximum you can use is $2,000.

Sezzle

Sezzle is another BNPL app that’s very similar to Quadpay.

Just like Quadpay, Sezzle lets you split up purchases into four equal payments, 25% due upfront and the rest split up over 6 weeks.

You don’t even have to pay interest and don’t need to report to credit bureaus.

Just sign up for your free Sezzle account to get started and link a card!

To split your payments, select Sezzle when you place a order.

It is very easy to use, and there are many great reviews.

Instant approval will be granted for many purchases without any impact to your credit score!

They are constantly growing and expanding so you have absolutely nothing to lose.

If you’re interested in deferred interest payments that are not subject to any fees, I recommend Sezzle.

Afterpay

Afterpay, which I highly recommend and is one of my favorite pay-later services like Quadpay, is the best.

Afterpay, an alternative payment system to traditional credit systems, was established in Australia in 2014.

A quick note to my U.K friends: Afterpay actually calls Clearpay here in the U.K. However, it is the exact same app as Clearpay from the same company.

Afterpay allows you to shop at thousands and defer interest-free payments.

The process is pretty much the same as other apps on this list…

Just sign up for a free account and then link a card.

That’s it and there is no credit check for Afterpay users!

Pay on time to avoid late charges

Afterpay is well worth the effort!

Acceptance

Affirm is a great alternative to Splitit that doesn’t charge any hidden or late fees.

However, Affirm only offers 0% interest for a few retailers unlike other apps on this list that always offer 0% interest.

There are three options for payment: 3-months or 6-months and 12-months.

It is easy to use Affirm. Just create an account, and you can start shopping with Affirm.

Nothing is hidden on Affirm, you will see exactly how much interest you will pay if you even have to pay interest.

You do have to have to go through a soft credit check to be eligible to use Affirm but it won’t affect your credit score.

Although Affirm may not be the most popular app, its simplicity and transparency make it worthy of a place on our list.

/Afterpay_vs_Klarna-01-e2a5f98b479b4905a071bb29ca849422.jpg)

Which Online Retailers Accept Afterpay

While Amazon does not take Afterpay, many of its rivals do, mainly clothes stores.

Afterpay is accepted by many retailers across America, particularly those that sell clothing and beauty products. It currently includes 7400 merchants from all 50 States, and it is growing every day.

It’s easy to find Afterpay-enabled apparel retailers that span the globe, including Forever 21, Levi’s, UGG, Pacsun, Old Navy, and more. With just one click, you may also get your hands on a variety of cosmetic items, such as Jo Malone London or Credo Beauty!

Although this retailer offers thousands of reasonably priced home products, customers who like to purchase now, pay later may prefer the Container Store or Bed Bath & Beyond since both allow Afterpay.

Another popular place to buy accessories is the supermarket. Still, if you need to buy now and pay later, Steve Madden, Crocs, Pandora, and various other brands offer Afterpay.

See more: How can I use my Amazon gift card?

Alternatives To Klarna

There seems to be an endless number of Buy Now, Pay Later companies popping up every time I shop online. They all offer slightly different features, but that goes beyond the scope of this article. BNPL companies include:

- Affirm (Known for having higher spending limits that can affect credit and can impact credit. Fixed-fee loans can be used to make in-store purchases.

- AfterPay (No hard credit checks, 0% loans, ontime payment history does not help build credit)

- Purchase Zip (Quadpay Online) at multiple retailers

- Only available for purchase online in Canada and the US. Sezzle is not available in as many major retailers as competitors.

You may also want to use a BNPL-based service.

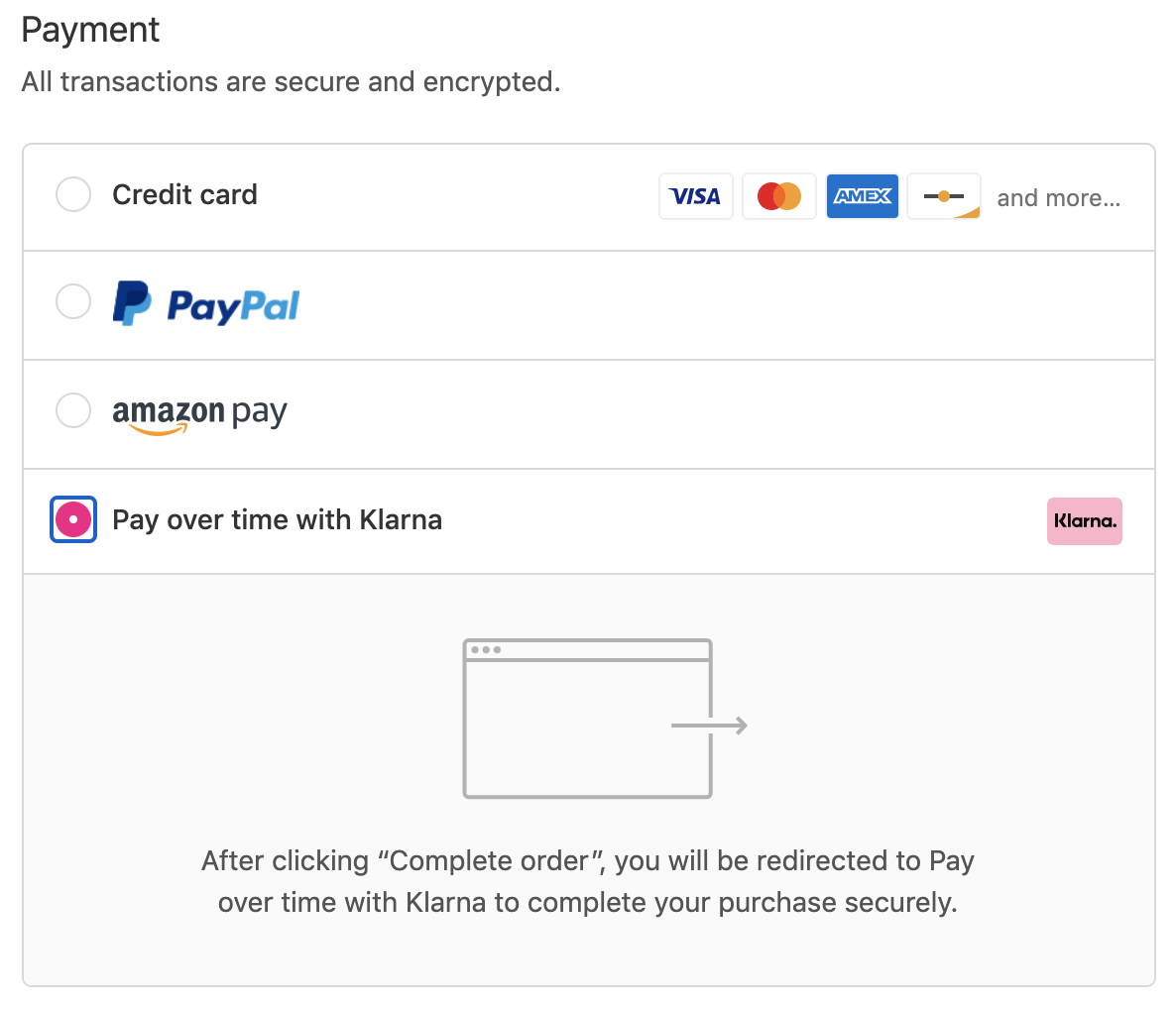

What If I Don’T Have The Klarna App But Want To Use Klarna?

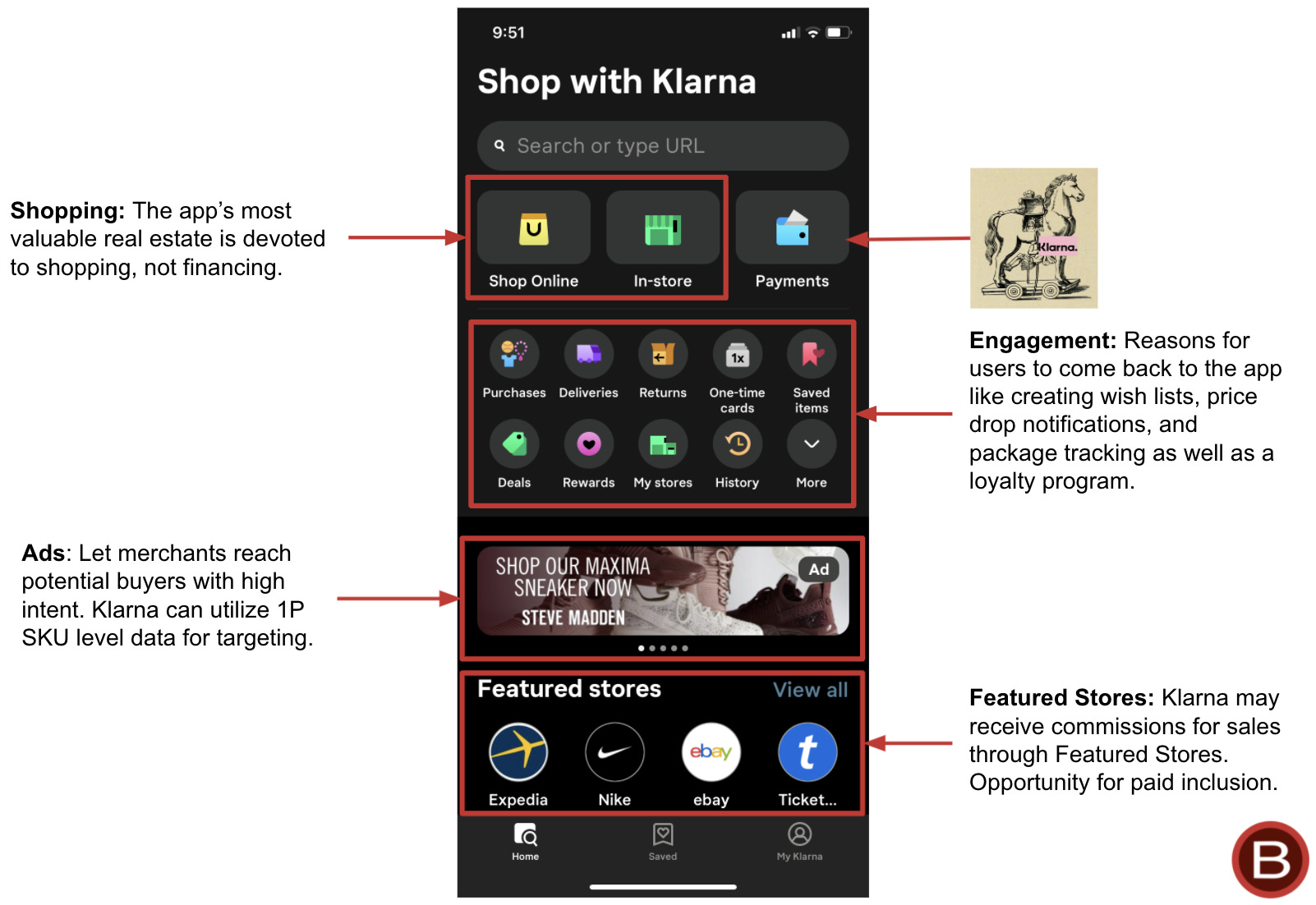

Klarna lets customers place online orders from their computer or laptop. You can also download the Klarna browser extension.

Once they have installed the browser extension, customers will be able to place Amazon products in their cart.

Once they’ve completed payment, “Pay with K” will appear on the screen. Customers can then choose their preferred payment method and proceed to their transaction.

However, customers should be aware that Klarna is currently only available to the Google Chrome browser.

Why Doesn’T Amazon Accept Afterpay?

So, the answer to “Does Amazon accept Afterpay?” is a no. The company doesn’t accept Afterpay as it would be too costly for Amazon, which is the largest e-commerce firm in the world.

Many businesses now offer Afterpay as a way to encourage customers and provide more flexible payment options. But, Amazon executives are skeptical about including Afterpay on their top e-commerce platform.

Afterpay is used by many shops to offer customers flexible payment options. However, this retailer doesn’t need to use this system because it already attracts many customers.

Amazon appears to have the perfect customer. They will be loyal, even if they pay with another method. But, of course, that is not to imply that this place will never provide Afterpay.

Afterpay is not well-known. It is not known if this option will be popular. You might choose to go with Amazon’s alternatives.

Even without Afterpay or similar programs, Amazon still leads in e-commerce as of 2021.

You may also like: How Late Does Amazon Deliver

Amazon

Amazon is another giant offering the option of buying now and paying later.

Amazon allows you to pay your purchase in installments over five months, interest-free.

There are some catch…

Not all items on Amazon have this option. Only a few items are eligible for this buy-now-pay later option.

If the option is available you will see this when going to purchase the item:

You will need to pay 20% upfront plus shipping costs. The remaining 80% will then be divided over 4 months. A payment is due each 30 days.

The payments will be automatically debited from your debit/credit card linked to your Amazon account.

There are no fees or interest for using this option so if you shop on Amazon this is definitely worth checking out!

What does Klarna do with Amazon?

Customers can either download the Klarna app for shopping on their mobile device, or they can download the browser extension to apply their Klarna Card to Amazon.com.

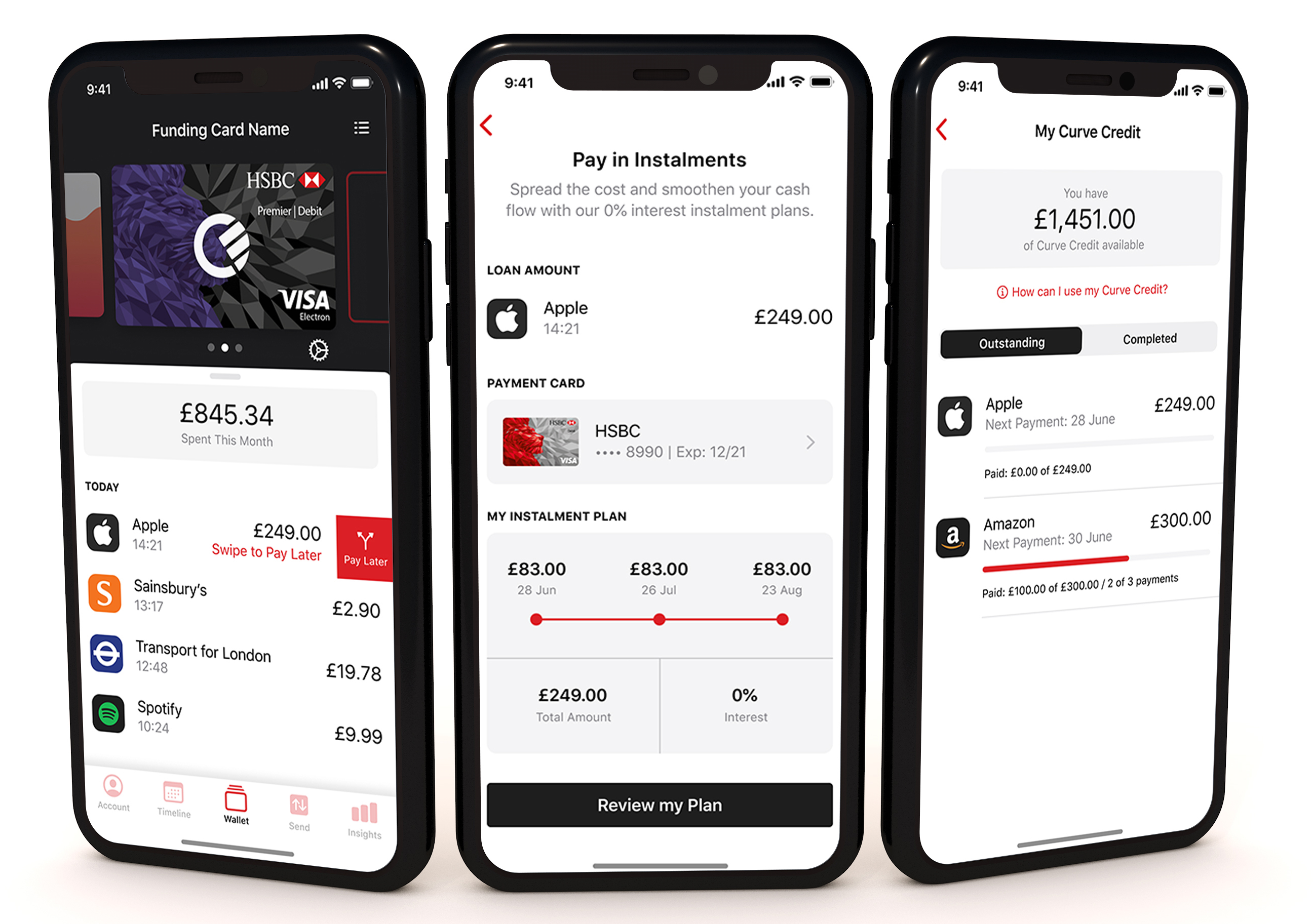

Amazon customers have the option to add items to their shopping carts and then pay in monthly installments, instead of one lump sum.

Customers can choose between a 4-installment plan paid out every two weeks, or a 30-day payment plan free of interest or additional fees.

Klarna allows Amazon customers to make lower payments for items that they normally would have to buy upfront. This is in addition to items already on Amazon which are eligible for a payment plan.

What happens if I can’t pay on time?

Two things might happen to you if you can’t pay your loan on time. Two things could happen to you if your loan is not paid on time.

- Klarna might impose late payments fees on your loan. This will increase the cost of the loan and make it harder to repay.

- Klarna BNPL Services may be blocked in the future.

Klarna won’t charge late fees, or even block your accounts without trying several times to take the money from your account. You will be notified via email about any unsuccessful payment.

That said, your missed payment will be added to the following payment schedule until you exceed the “4 interest-free payments” before sanctions apply.

Amazon: Is it possible to “Buy Now and Pay Later?”

This payment option is for items that this company makes. They are called Fire tablets, Kindle e-readers, and Echo intelligent home gadgets. These devices are the best-selling.

Amazon is the best place to find great tech gadgets at affordable prices. Any available plans on the product detail page should be visible if you decide to purchase one of their leading tech gadgets.

The first payment is payable before the gadget is sent to you, and then four equal monthly installments are charged to your chosen paying way every month.

By signing up for a store card, you will see more choices and special incentives when you purchase on a website or app.

Klarna Features

Klarna is a partner with more than 5,000 US merchants, including top retailers such as Sephora, Foot Locker and GameStop. You can also use the Klarna app to make purchases at any U.S. retailer that accepts debit and credit cards. This app offers more flexibility than any other point-of sale app.

Klarna performs a soft credit check when you apply for an account, which will not impact your credit score. However, if you opt for the financing option, they will do a hard credit pull, which will show up as an inquiry on your credit report.

Vibe is Klarna’s rewards program. For every $1 spent through the app, you earn one vibe (or reward point). You can redeem your vibes for gift cards from Amazon, Best Buy, Sephora and other major retailers.

Does Amazon Accept After Pay Or Klarna:

Once you’ve downloaded the Klarna app, you can pay at Amazon. Simply search for the site from the home screen of your app and click on “Pay with K” at the checkout. Please note that Amazon will no longer accept After pay as of 2022, but you can still use Klarna for purchases on Amazon. For purchases through your Amazon Card, the special financing program lets you use Layaway, After Pay, or other payment options.

Klarna has multiple payment options when it comes to Amazon items. For example, the Pay in 4 plan allows you to split your purchase cost into four equal payments. Two weeks after the second installment, you will be due the third. The first installment is due when you complete the checkout process. There will be a late payment fee up to $7, however this option is attractive. You can also manage your budget and cash flow easily.

Are you able to use pay later?

To make payments with Klarna, you can use your debit or credit card. Monthly payments can be made with either a debit or credit card. In the U.S., it’s possible to pay in four installments and split the total amount into equal payments. It usually takes between four and five days to process a refund. You can also use the Pay In 4 Plan if you are unable to pay full payment immediately.

You can also choose to pay with Klarna with your credit card. Klarna cannot accept cash payments, but you can use your credit or debit card to pay. To use this service, however, you’ll have to pay high interest rates. In other words, using this service will not improve your credit. This will not improve your credit score. You must make payments in a timely manner.

You can pay in 30 days

Klarna offers a pay in 30 day option that allows you to get your order immediately without interest and fees. Klarna then provides up to 30 days to make the full payment. This is a great option if you want to try something before you buy it without using your debit or credit card.

Splitit gives you more time to pay — up to 24 interest-free installments

If your favorite online retailer accepts SplitIt, you can divide your payments up into monthly payments between 3 and 24 months.

SplitIt is all you need to do. Simply select SplitIt when checking out, enter your payment card and then set up the repayment schedule. The card will automatically be charged without interest, credit checks or late fees.

Does Klarna Guarantee Approval?

Klarna cannot guarantee approval. Their website states that their goal is to encourage responsible spending and ethical behavior.

- Internal data such as past payment history

- Balances not paid

- Length of time you have been a customer

- Your total purchase amount

- Fraud prevention: Too many transactions in too short a time.

Helpful Information

- Every purchase is considered an individual decision. Rejection does not necessarily mean that all subsequent purchases will be rejected.

- A rejection does not impact your credit score

Does Klarna Have A Limit?

What is the Credit Limit? Klarna does not have a spending or credit limit. This is determined purchase-by-purchase. 4 So if you’re wondering, “Where can I see my credit limit?” the answer is that you can’t.

Does Nike Offer Credit Cards?

Our goal is to make it easy for you to buy your Nike gear and shoes. We accept Visa, MasterCard and American Express payments. Apple Pay.

Klarna: Who should use it?

Klarna is a good option for:

- You do not qualify for a credit card or you do not want to use your credit card

- Looking to spread out the cost of a gift for special occasions e.g Holiday or Birthday

- The purchase can be paid off in 6 weeks

Klarna isn’t a great option:

- You are trying to improve your credit score

- Have generally poor repayment habits

- You want to use the financing option, as it has a high-interest rate

How does Nike Code 98D2586B work?

Nike throws a 98D2586B error if you place more than 1 order online in a day. It can be fixed by ordering only once per 3 days from the @nikestore. … Nike will not reply to DMs. It takes three days for an email to reply.

Splitit

Splitit, as the name suggests, allows you to split your post delivery payment in up to 24 installments without interest.

Like Klarna, Splitit charges no prepayment and application fees and doesn’t affect your credit score.

Splitt’s flexible payment options, which range from three to 24 installments, is what I love about it.

Check it out

Can I Use Klarna On Amazon Without The Klarna App?

Klarna can be used by customers who prefer to shop online from their desktops or laptops.

Once customers have downloaded the browser extension, they can add items from Amazon into their cart.

Once they’re ready to pay, the “Pay With K” option will pop up on their screen, which customers can select and process their payment with.

However, customers should be aware that Klarna is currently only available to the Google Chrome browser.

What Credit Score Do You Need For Klarna?

Klarna doesn’t set a minimum credit score to qualify for financing. Actually, it’s possible to get credit with no prior history. If you choose to four interest-free installment payments, the company may conduct a soft credit pull. It does not affect your credit score.

Does Amazon Accept Klarna In 2022? (All You Need To Know)

Amazon allows customers to pay using a variety payment methods via its website or mobile app. Amazon’s mobile app and website offer a number of payment methods. Customers have the option to use Amazon gift vouchers, credit and debit card, or Amazon gift cards.

Does Amazon Accept Klarna In 2022?

Amazon recently integrated Klarna into their payment options for Amazon.com. Klarna customers can use the app to pay for their purchases. After adding Amazon products to their shopping cart, customers can checkout and pay using the 4-instalment payment plan.

Klarna: Does Amazon Work with Klarna?

Klarna, a “buy Now Pay Later” app allows Amazon customers make Amazon purchases using a 4-instalment payment plan.

Customers can either download the Klarna app for shopping on their mobile device, or they can download the browser extension to apply their Klarna Card to Amazon.com.

Amazon lets customers add every item to their cart. They can also pay monthly instead of one lump-sum payment.

Customers can select from either a 4-week installment plan, which is payable every other week, or a 30-day plan with no interest or extra fees.

Klarna allows Amazon customers to make lower payments for items that they normally would have to buy upfront. This is in addition to items already on Amazon which are eligible for a payment plan.

Can I Use Klarna for an Amazon Payment Plan?

Amazon offers a selection of items from their catalogue that can be paid for in installments. These include furniture, electronics and other electronic products. The payments are made in five equal monthly installments, over a period of 120 days.

Klarna is also available to customers. It offers a shorter payment period than Amazon’s regular plans.

Klarna’s “buy now, pay later” application is meant to be used in conjunction with a credit-card.

Therefore, customers cannot select Klarna and the Amazon payment plan for the same order.

Kann Klarna be used on Amazon without the Klarna App

Klarna’s browser extension can also be downloaded for those who shop on the desktop or laptop.

Customers can download and install the browser extension to allow them to purchase items directly from Amazon.

Once customers are willing to pay, they will see the “Pay With K” option. From there, they can pick and choose which payment method to use.

However, customers should be aware that Klarna is currently only available to the Google Chrome browser.

How do I Use my Amazon Klarna Card One-Time?

Amazon customers can make use of their One-Time Klarna cards by going to the Klarna app and selecting the Home tab. Then, search for Amazon in your search bar.

Customers can create the One Time Klarna cards at any time.

Can I Use Klarna for Amazon Prime?

Customers may choose to split their Amazon Prime membership into one payment for 30 days or opt for a four-instalment plan that is paid each two weeks.

Klarna Prime customers have two options to pay their subscription: the Klarna application or the browser extension. This allows them to access their account from anywhere they are connected.

For more information, please visit our post on Amazon Pay and Afterpay.

Amazon allows customers to make payments using Klarna, a “buy now, pay later” app that Amazon customers to make purchases using a payment plan. Customers can either pay within 30 days or set up a 4 installment plan to be paid out every two weeks.

Klarna also can be used in the Amazon app using the Klarna app, or online at Amazon.com with the Klarna browser extension.

Klarna and Amazon compatible

How to use Klarna at Amazon. Get the Klarna application and go to Amazon. Start adding products to your shopping cart by searching for Amazon from the home screen. After adding everything to your cart go to the checkout page and click “Pay with K.” at the bottom.

Does Amazon Accept Afterpay Or Klarna?

Unfortunately, Amazon does not accept Afterpay as of 2022. Amazon’s special financing program offers afterpay, layaway and other options to cardholders. This is for shoppers who own Amazon cards or buy Kindle ereaders/fire tablets, or Alexa products. Amazon customers also have the option to use Pay-in-4 through Klarna or Zip.

Amazon offers a pay later option

Amazon Pay Later: Once you have completed the set-up, Amazon Pay Later can be used to pay for your order at Amazon.in. You will then be able to use it later, or make payments over multiple EMIs, ranging between 3 and 12 months.

What can I do to make my Amazon account eligible for monthly payments?

To get started with Amazon Monthly Payments, you’ll first need to check if your account is eligible. The Monthly Payments can be used only if you own an Amazon account that has been in existence for at least 1 year and you are a resident of the United States. You also need to have a valid creditcard tied to Amazon’s account.

.Does Amazon Accept Klarna In 2022? (All You Need To Know)

:fill(white)